Car loan calculator based on credit score

If your credit score is lower 300-600 youll pay higher interest rates. If you have a fixed budget in mind the car loan calculator can still work for you.

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet

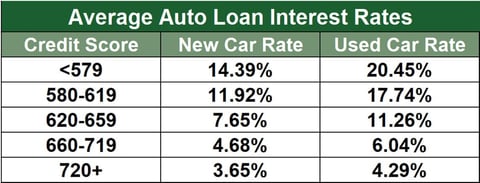

You can see that working to get your score in the higher ranges can mean a big savings.

. A good credit score is typically between 700 and 750 and an excellent credit score is typically above 750. Skip up to the equivalent of monthly payment each year 1 Disclaimer Interest continues to accrue. The information contained in Ask Experian is for educational purposes only and is not legal advice.

Use Carvanas auto loan calculator to estimate your monthly payments. A credit score of 750 and above is considered a healthy credit score by most lenders. To qualify for a car loan with a bad credit score below 580 there is a large network of lenders and car dealers who are more willing to work with low- and bad.

Or 28 days if applicable remaining on the loan the calculation will be based on the. The short answer is yesyou can refinance your car loan. Use Bank of Americas auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan.

Based on Similar Web data 851826 to CarFinance 247 vs. Credit score If you have good credit in the range of 660-850 lenders will usually offer you a lower interest rate because you are a lower-risk loan. Moreover FICO publishes interest rates with the corresponding credit score under their Home Purchase Center.

As a cherry on top financing with a low interest rate is better for your credit score. The average auto loan rate is 433 for new cars and 862 for used cars according to Experians Q2 2022 State of the Automotive Finance Market report. You should consult your own.

A higher score can help you secure a better interest ratewhich means youll have a lower monthly car payment. The Loan Savings Calculator shows how FICO scores impact the interest you pay on a loan. If you get pre-qualified or preapproved.

Buy Car Calculator. To understand how paying off a car loan can affect your credit score its important to have a basic knowledge of what information your FICO Score is based on. For ideas on where to invest your extra car cash.

For example a bank determines the interest rate you qualify for based on your credit score debt-to-income ratio and other factors. Down Payment - 1000. You can also check online lenders for rates.

HDFC Bank Car Loan offers lowest interest rate. If interest rates have dropped since you took out your car loan or you now have a better credit score then you can refinance to a lower. How Much Should You Pay for Full Coverage Insurance.

How quickly in months do you plan. This will allow HDFC Bank to offer interest rates based on the credit history. Check our financing tips and find cars for sale that fit your budget.

Including HDFC Bank consider when determining your eligibility for a car loan. 395 is based on average credit score. Car Loan EMI Calculator Best Offers Apply Now.

Suppose you pre-qualify for a car loan and know the interest rate and the sales tax rate in your area. We want to make managing your car loan payments easy whether you want to pay off your loan early or need some breathing room once in a while. Get your dream car with a NatWest car loan.

A Higher FICO Score Saves You Money. Car loan amortization calculator harnesses all the factors influencing borrowing and repaying car loans distilling your loans payment amount at various intervals. Estimate based on your credit rating Vehicle Budget 20000.

Start Your Free Online Quote in 3 Mins. As you can see borrowers with the highest scores are entitled to the lowest rates. See how interest rate down payment loan term will impact your monthly payments.

Your financial history the type of car loan you need and your credit score. To minimize the amount of interest paid increase the amount of. At the top of the calculator you can select your credit score on the drop down to see average car loan rates.

In most cases well confirm the loan amount and your rate at the start of your application with no impact on your credit score. In that case its easy to calculate and estimate your vehicle loan payment using our car calculator tool. Just change the amount to borrow and loan term until you land on the figure that youre comfortable with.

If the loan you paid off was the only account with a low balance and now all your active accounts have a high balance compared with the accounts credit limit or original loan amount that might also lead to a score. Get real rates on inventory for up to 45 days. Our calculator makes it easy to see how much you can borrow.

As of December 4 2020 the following table shows the. It might be tempting to push out your car loan term on the Car Affordability Calculator to lower your monthly payments. Paying Off a Loan May Lead to a Temporary Score Drop.

Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether. While the exact FICO formula. You could even end up paying thousands of dollars more in interest than someone with a better credit score.

Compare Top 10 Best Rates Now Save. The balances on your open accounts can also impact your credit scores. Poor 639 or less Fair 640 - 699 Good 700 - 749 Excellent 750 - 850 Calculate.

Ad Full Coverage Auto Plans from 19 Month. Credit score calculated based on FICO Score 8 model. After all in our earlier example if we extend the term from 48 to 72 months the.

Meanwhile lower credit score borrowers get lower rates or may not be approved for a loan at all. Through RBC Online Banking you can stay on top of your car loan 247. Based on the graph above we can see that the interest rates for auto loans are affected by loan term lengths especially for used cars.

How does credit score affect auto. Save Time on Finding Your Best Price From Local Dealers. One of the main factors lenders consider when you apply for a loan is your credit score.

Select your loan type and state enter the appropriate loan details and choose your current FICO score range. Skip a loan payment. Ad Find Limited Time Offers on a New Vehicle in citydisplay_nameYour Area.

No impact to your. Calculate your monthly Boat payments with NADAguides Boat loan calculator. Interest Rates are calculated based off of borrowers credit scores and the amount of money being lent.

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

Car Loan Options Used Auto Loans Vs New Car Loans Car Loan Calculator Car Loans Car Finance

Do I Qualify For Car Loan Car Loans Car Finance Loans For Bad Credit

Average Auto Loan Interest Rates Facts Figures Valuepenguin

What Is A Good Credit Score Visual Ly Good Credit Score Credit Score Infographic Credit Repair

Auto Loan Payment Calculator Spreadsheettemple Car Loans Car Loan Calculator Loan

17 Bad Credit Car Loans 2022 Badcredit Org

Pin On Financial Education

What Credit Score Is Needed To Buy A Car Lendingtree

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

Consider This Before Rolling Your Current Car Loan Into A New One Car Loan Calculator Car Loans Loan Calculator

Pin Page

Here S The Average Car Loan Interest Rate By Credit Score Car Loans Credit Score Loan

The Average Auto Loan Interest Rate By Credit Score Loan Term And Lender Loan Interest Rates Car Loans Car Loan Calculator

Auto Loan Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Loan Calculator Car Payment

Get Instant Best Free Auto Car Loan Quote Through Special Online Auto Loan Providing Company We Also Help Individual Car Loans Car Loan Calculator Online Cars

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair